Tax Foundation

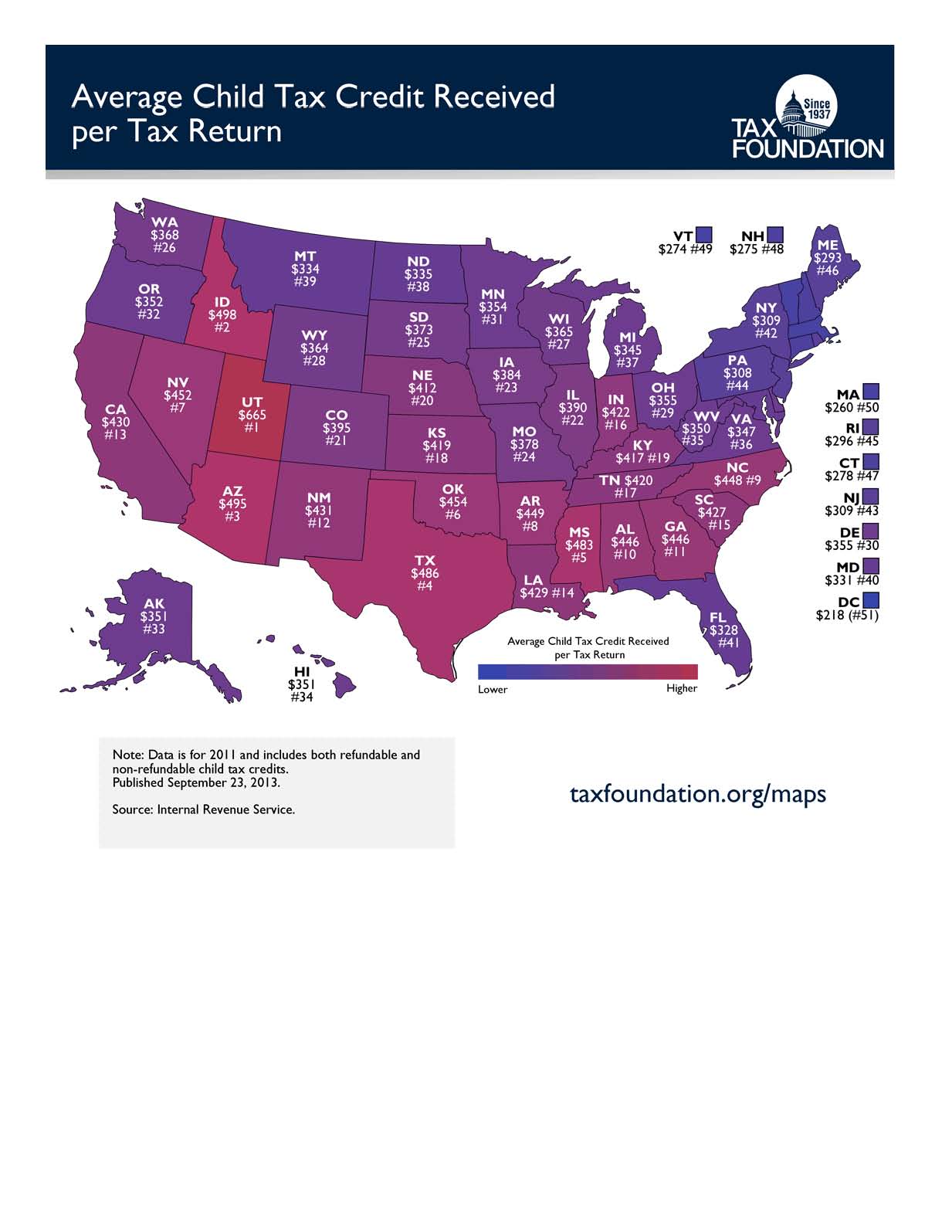

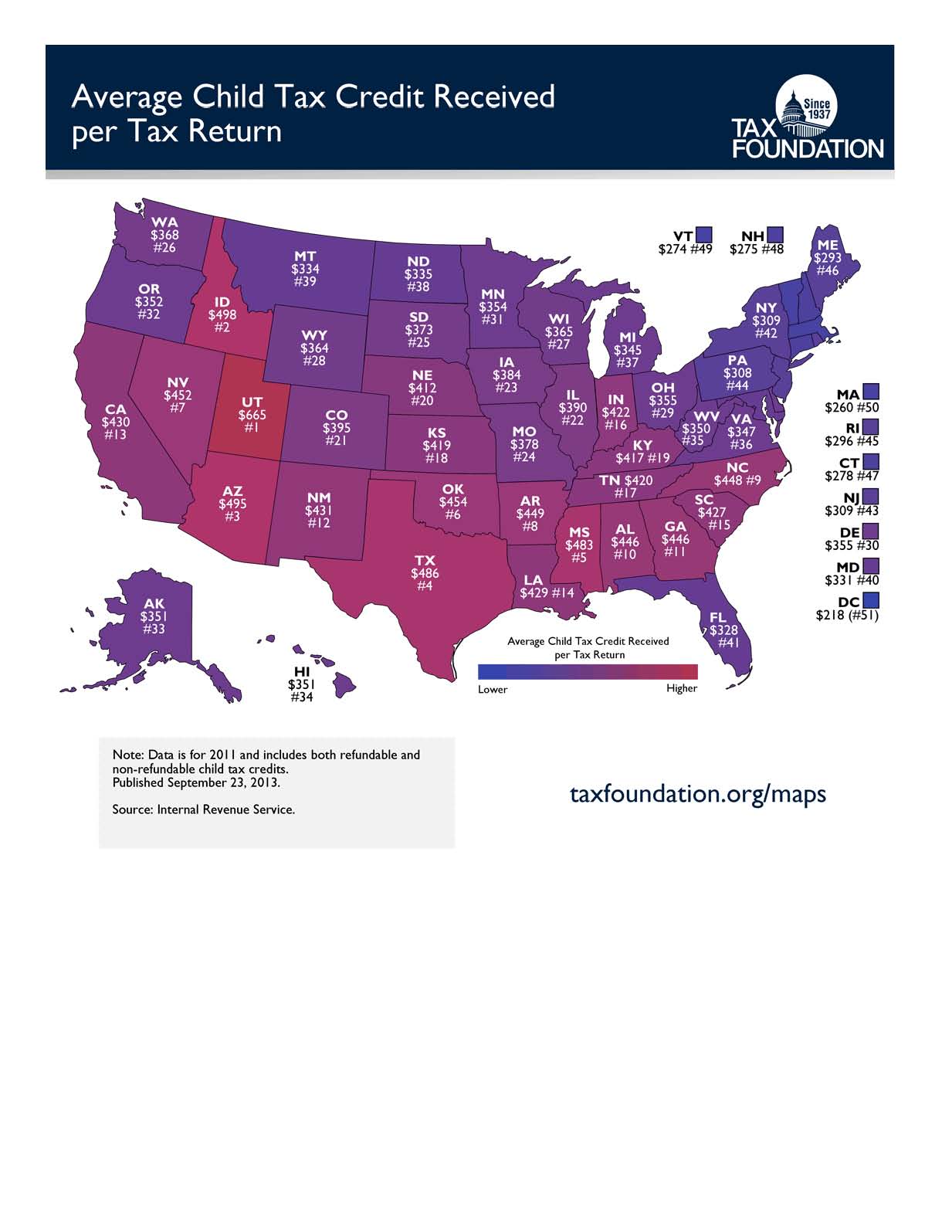

Senator Mike Lee of Utah has proposed adding a child tax credit of $2,500 per child, which is in addition to the existing child tax credit of $1,000 per child. This week’s map shows which states benefit most from the existing child tax credit, in terms of the average dollar amount per tax return. Utah gets far and away the biggest benefit, at $665 per tax return, followed by neighboring states Idaho, at $498 per tax return, and Arizona, at $495 per tax return. Massachusetts gets the smallest benefit, at $260 per tax return. (This is per tax return, not per tax return claiming the child tax credit)

While it varies from state to state, about half of the cost of the child tax credit is from the refundable portion, i.e. the amount in excess of any federal income tax liability. The child tax credit knocks millions of households off the federal income tax rolls, and, because of the refundable portion, is a major contributor to the situation where about 40 percent of households have a negative federal income tax rate. The child tax credit is available to most households (with at least one child) and begins phasing out at $75,000 for single filers and $110,000 for joint filers.

The child tax credit has been expanded in stages since its introduction in 1996. It is now one of the largest tax expenditures, costing $57 billion in lost federal income tax revenue.

While it varies from state to state, about half of the cost of the child tax credit is from the refundable portion, i.e. the amount in excess of any federal income tax liability. The child tax credit knocks millions of households off the federal income tax rolls, and, because of the refundable portion, is a major contributor to the situation where about 40 percent of households have a negative federal income tax rate. The child tax credit is available to most households (with at least one child) and begins phasing out at $75,000 for single filers and $110,000 for joint filers.

The child tax credit has been expanded in stages since its introduction in 1996. It is now one of the largest tax expenditures, costing $57 billion in lost federal income tax revenue.